Taipei, Feb 21st, 2023 – PChome Online announced financial results for the fourth quarter ended Dec 31st, 2022 today. We provided consolidated financial statements and standalone financial statements as follows. The consolidated financial statements reflect performance across all BUs, including B2C, Marketplace, Fintech, and Others. The standalone financial statements reflect a clearer picture of the B2C business.

Corporate Actions:

● The Board of Directors has resolved to conduct a rights offering, with the issuance of 8 million to 16 million common shares to repay bank loans or increase working capital.

● The Board of Directors has approved a reorganization plan for marketplace BU to better integrate resources between Ruten and PCStore and drive operational efficiency of both C2C and B2B2C platforms. The reorganization plan includes a capital restructuring and the equity transaction of PCStore. Following the reorganization, PCStore will become wholly owned by Ruten, a 65% subsidiary of PChome.

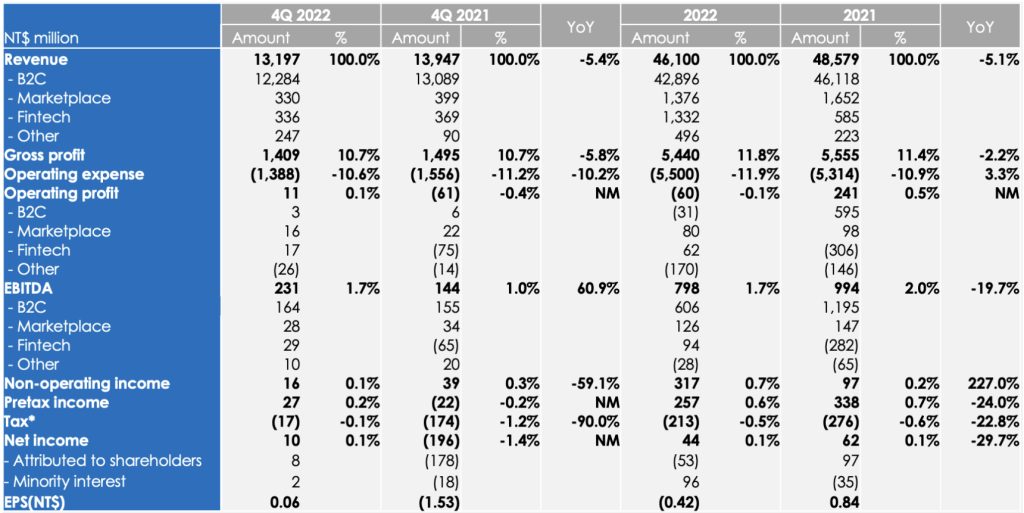

Full Year 2022 Consolidated Financial Highlights:

● The consolidated revenue was NT$46,100 million (-5.1% YoY). B2C BU sales amounted to NT$42,896 million (-7.0% YoY), Marketplace BU sales were NT$1,376 million (-16.7% YoY), Fintech BU sales were NT$1,332 million (+127.8% YoY), and Other BU sales were NT$496 million (+122.3% YoY).

● The consolidated operating loss was NT$60 million, with B2C BU’s operating loss at NT$31 million, Marketplace BU’s operating profit at NT$80 million, Fintech BU’s operating profit at NT$62 million, and Other BU’s operating loss at NT$170 million, which includes consolidation adjustments and eliminations.

● The consolidated non-operating income was NT$317 million in 2022, consisting of NT$169 million recovery gain from Fintech BU and NT$145mn revaluation gain from Chunghwa PChome Fund I.

● Fintech BU reported a consolidated pretax income of NT$231 million in 2022, compared to a consolidated pretax loss of NT$272 million in 2021, and achieved its first-even profitability because of the focused efforts on integration, restructuring, and strategic acquisitions. The turnaround was driven not only by revenue and profit growth from the strategic acquisitions but also by the synergies created through innovative products such as PayLater, the first integration of E-wallet and installment service, and the first and most flexible “12-month iPhone Subscription Program” in Taiwan.

● The tax expense was NT$213 million in 2022, including NT$84 million of one-time capital gain tax and income tax of NT$130mn from Fintech BU and Other BU.

● The consolidated net income was NT$44 million, while net income attributed to minority interest was NT$96 million. As a result, net loss attributed to shareholders and EPS was NT$53 million and negative NT$0.42, respectively.

Fourth Quarter 2022 Consolidated Financial Highlights:

● The consolidated revenue was NT$13,197 million (-5.4% YoY) in 4Q 2022, with B2C sales of NT$12,284 million (-6.2% YoY), Marketplace sales of NT$330 million (-17.2% YoY), Fintech sales of NT$336 million (-8.7% YoY) and Other sales of NT$247 million (+176.0% YoY).

o B2C: 3C categories sales declined 5.3% YoY and accounted for 74.7% of total B2C sales in 4Q 2022 (vs. 72.3% in 3Q 2022 or 74.0% in 4Q 2021). Non-3C categories sales declined 8.7% YoY and accounted for 25.3% of total B2C sales in 4Q 2022 (vs. 27.7% in 3Q 2022 or 26.0% in 4Q 2021).

o Fintech BU sales down 8.7% YoY was attributed to a one-time revenue adjustment of NT$35 million for 2022 full year impacted on 4Q 2022.

o Other BU demonstrated strong sales growth of 176.0% YoY, primarily driven by Bibian, the group’s cross-border e-commerce platform.

● The consolidated gross margin held steady at 10.7% YoY in 4Q 2022, consistent with 4Q 2021 and lower than 3Q 2022’s 12.9% due to higher competition in the traditional shopping festival in 4Q 2022.

● The consolidated operating expenses ratio improved to 10.6% in 4Q 2022 (vs. 11.2% in 4Q 2021), which was a result of B2C BU’s budget control efforts.

o Selling and Marketing expenses ratio was 7.3% in 4Q 2022 (vs. 8.4% in 4Q 2021), with a reduction of NT$ 217 million, reflecting the advertising expense optimization of B2C BU despite an increase in related expense from fintech & cross border as the business scaled.

o General and Administrative expense ratio was maintained at 1.3% in 4Q 2022 (vs. 1.3% in 4Q 2021) with a decreasing amount of NT$6 million.

o Research and Development expenses ratio increased to 1.2% in 4Q 2022 (vs. 1.0% in 4Q 2021) with investment in cloud migration and UIUX optimization for B2C BU.

● Consolidated operating profit was NT$11 million in 4Q 2022, up NT$72 million from the same period last year.

o B2C BU’s operating profit was NT$3 million in 4Q 2022, making an end to two consecutive quarters of losses and reflecting the efforts of cost control and a better marketing expense allocation.

o Marketplace BU’s operating profit remained stable at NT$16 million despite increasing e-commerce competition.

o Fintech BU’s operating profit was NT$17 million and recorded a recovery gain of NT$46 million, totaling a NT$63 million pretax profit in 4Q 2022 which is an increase of NT$138 million compared to a NT$75 million loss in 4Q 2021.

o Other BU, including cross-border business, consolidation adjustments, and eliminations, reported an operating loss of NT$26 million in 4Q 2022.

● The Consolidated Non-operating income was NT$16 million in 4Q 2022, consisting of the NT$36 million investment revaluation loss from Chunghwa PChome Fund I and the recovery gain of NT$46 million from Fintech BU.

● The tax expense was NT$17 million, including NT$16 million amortization of capital gain tax due to the share exchange of 21CD & Pi Wallet this year.

● The consolidated net income was NT$10 million, net income attributed to minority interest was NT$2 million, net income attributed to shareholders and EPS was NT$8 million and NT$0.06, respectively.

PChome Online Inc.: Consolidated Income Statement

PChome Online Inc.: Standalone Financial Statement

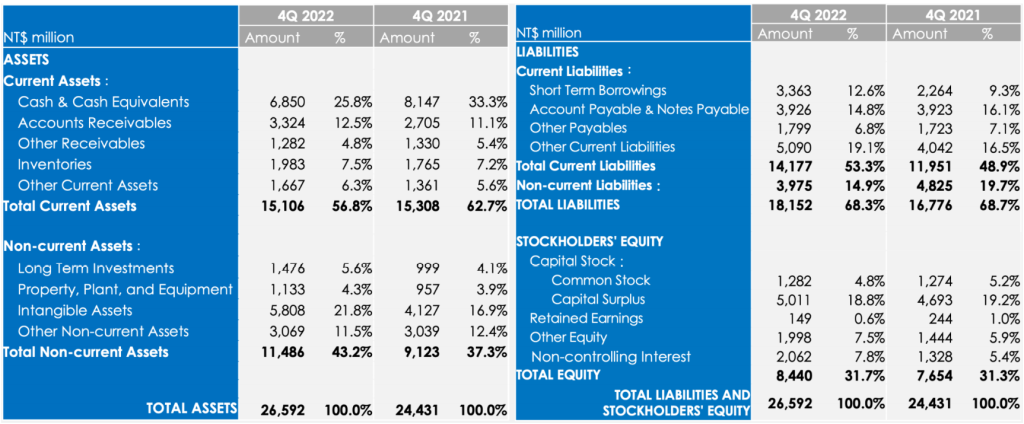

PChome Online Inc.: Consolidated Balance Sheet

.jpg)