Corporate Governance

Investor Relations

Committee

Audit Committee

The Company’s third Audit Committee, officially established on June 19, 2024, is composed of three independent directors, with Mr. He Chendan, an independent director, elected as the convener. The committee is responsible for reviewing the fair presentation of the Company’s financial statements, the selection and dismissal of the certifying accountants, their independence and performance, the effective implementation of the Company’s internal controls, compliance with relevant laws and regulations, and the management of existing and potential risks . The Audit Committee meets at least quarterly, with the accountant, the head of internal audit, and the head of the finance and accounting department participating and reporting. The accountant reports to the Audit Committee on the status of the financial statement review (or audit), and the audit department reports to the Audit Committee on internal controls and audit content.

| Name | Professional qualifications and experience (academic background) | |

| Convener and Audit Committee | Tan Hochen | Master’s degree from Virginia State University; Minister of Transportation of the Republic of China; Chairman of Chunghwa Telecom Corporation |

| Audit committee | Lambert Chien | Master of Electrical Engineering, Stanford University Chairman of KKCulture Inc |

| Audit committee | Du Yijin | Master of Information, National Taiwan University Independent Director of Chunghwa Telecom Corporation Chairman of the Taiwan Artificial Intelligence Development Foundation Director of the Institute for Cultural Content Planning |

The work priorities in 2024 are as follows:

The company is currently the second audit committee. It was officially established on July 29, 2021. It consists of three independent directors. The independent director Mr. He Chendan was elected as the convener. It meets at least once every quarter and is responsible for auditing the company’s financial statements. proper expression, the selection (dismissal), independence and performance of certified public accountants, the effective implementation of the company’s internal controls, the company’s compliance with relevant laws and rules, and the management and control of the company’s existing or potential risks, etc.

(1) Establish or amend the internal control system in accordance with Article 14-1 of the Securities and Exchange Act.

(2) Assessment of the effectiveness of the internal control system.

(3) Establish or amend the procedures for handling major financial business activities such as acquiring or disposing of assets, engaging in derivatives transactions, lending funds to others, endorsing or providing guarantees for others, in accordance with Article 36-1 of the Securities and Exchange Act.

(4) Matters involving directors’ own interests.

(5) Significant asset or derivatives transactions.

(6) Significant capital loans, endorsements or guarantees.

(7) Raising, issuing or privately placing securities of an equity nature.

(8) Appointment, dismissal or remuneration of certified accountants.

(9) Appointment and removal of financial, accounting or internal audit supervisors.

(10) Annual financial report and semi-annual financial report.

(11) Other major matters stipulated by the company or the competent authority.

The Audit Committee convened 5 meetings in 2024 (A). The attendance is as follows:

| Title | Name | Attendance in Person (B) | Attendance Rate (%) (B/A) | Remarks |

| Audit Committee member | Hechen Tan | 6 | 100% | Assuming office on Juln 19, 2024 |

| Audit Committee member | Lambert Chien | 3 | 100% | Assuming office on Juln 19, 2024 |

| Audit Committee member | Du Yijin | 6 | 100% | Assuming office on Juln 19, 2024 |

Other mentionable items:

I.The date, session, content of the motion, resolution of the Audit Committee and the Company’s means of processing the opinions of the Audit Committee shall be specified if one of the following circumstances occurred in the operation of the Audit Committee:

(I)Matters listed under Article 14-5 of the Securities and Exchange Act:

| Date of Meeting | Content of Motion | Opinions of all Independent Directors and the Company’s handling of these opinions |

| 2024.02.22 | Approval of 2023financial statements. | Approved by all Independent Directors |

| 2024.03.19 | Review and approval of 2024 CPA fees | Approved by all Independent Directors |

| 2024.08.13 | Approval of 2024 financial statements for the Second Quarter. | Approved by all Independent Directors |

| 2024.11.13 | Approved the 2025 annual audit plan | Approved by all Independent Directors |

Other matters not approved by the Audit Committee but approved by more than two-thirds of all directors: In the absence of such circumstances, there were no objections or reservations from the independent directors this year.

Communication methods between independent directors, internal audit supervisors and CPA

1. Communication situation between independent directors and CPA:

(1)The company’s independent directors and CPA communicate and discuss in writing every year on the company’s financial status and the design and implementation of the internal control system. When necessary, the accountants also communicate and discuss in writing. The scope includes the accountants’ review of the independence and related responsibilities of the financial statements, and audit Plan related matters, review major findings (including adjusting entries and significant deficiencies in internal controls, etc.), review report content and review results of interim consolidated financial statements; in addition, accountants may communicate with independent board meetings from time to time as necessary.

(2)An excerpt of the main communication matters between independent directors and accountants is as follows:

| Date | Meeting | Key points of communication | Opinions and results of independent directors |

| 2024/02/22 | Audit Committee Report | Accountant Independence Report 1. Responsibilities of auditors for reviewing financial reports 2 Scope of inspection and description of findings 3 Key Assessment Matters (KAMs) in 2023 4 Matters of concern to the competent authorities | The independent directors had no special instructions or opinions at this meeting. |

| 2024/04/29 | Audit Committee Report | Accountant Independence Report Responsibilities of 2023Q1 financial report reviewers in reviewing interim financial reports 2024Q1 Financial Report Review Scope Discovery Explanation and Legal Updates | The independent directors had no special instructions or opinions at this meeting. |

| 2024/08/13 | Audit Committee Report | Accountant Independence Report Responsibilities of2024Q2 financial report reviewers in reviewing interim financial reports 2024Q2 financial report review scope, review opinion types and legal updates | The independent directors had no special instructions or opinions at this meeting. |

| 2024/11/13 | Audit Committee Report | Accountant Independence Report Responsibilities of 2024Q3 financial report reviewers in reviewing interim financial reports 2024Q3 financial report review scope, review opinion types and legal updates | The independent directors have no special instructions or intentions at this meeting. |

2. Communication situation between independent directors and internal audit manager:

(1) The company’s audit unit and independent directors and supervisors shall submit the audit report and defect tracking report for the previous month at least before the end of each month; in addition, each board meeting shall submit a report on the implementation status of the company’s annual audit plan and the tracking and improvement of internal control defects. , and hold discussions with independent directors from time to time.

(2) An excerpt of the main communication matters between the independent directors and the internal audit manager is as follows:

| Date | Meeting | Key points of communication | Opinions and results of independent directors |

| 2024/04/29 | Audit Committee Report | Accountant Independence Report Responsibilities of 2024Q1 financial report reviewers in reviewing interim financial reports 2024Q1 Financial Report Review Scope Discovery Explanation and Legal Updates | The independent directors had no special instructions or opinions at this meeting. |

| 2024/08/13 | Audit Committee Report | Accountant Independence Report Responsibilities of2024Q2 financial report reviewers in reviewing interim financial reports 2024Q2 financial report review scope, review opinion types and legal updates | The independent directors had no special instructions or opinions at this meeting. |

| 2024/11/13 | Audit Committee Report | Accountant Independence Report Responsibilities of 2024Q3 financial report reviewers in reviewing interim financial reports 2024Q3 financial report review scope, review opinion types and legal updates | The independent directors have no special instructions or intentions at this meeting. |

Remuneration Committee

The Board of Directors of this Company has established a Remuneration Committee in accordance with the approved Remuneration Committee Organizational Charter. Its primary responsibilities are to perform the following duties and submit its recommendations to the Board of Directors for discussion. (1) Establish and regularly review the policies, systems, standards, and structures for the performance evaluation and remuneration of directors and managers. (2) Regularly evaluate and determine the remuneration of directors and managers. Following the re-election of the Board of Directors at the 2024/6/19 Shareholders Meeting, the Company appointed and established the Remuneration Committee on the same day. The Committee meets at least twice a year, with Mr. Du Yijin, an independent director, serving as the convener and chairperson of the meetings. The Committee has been operating smoothly to date.

| Body Separation | condition name | Professional qualifications and experience | Independence situation (Note 3) | concurrently serve in the number of households |

|---|---|---|---|---|

| Convener Independent Director | Du Yijin (Convener) | Experience: Chief R&D Officer for Microsoft Asia Pacific, leading the development of artificial intelligence services in Asia; Chief Development Manager of Microsoft’s Artificial Intelligence and Research Department; Founder of PTT Business Forum. Expertise/Research Areas: AI, artificial intelligence data governance, software platform R&D, digital talent development. | Independence requirements include: 1. The individual, their spouse, or any relative within the second degree of kinship does not serve as a director, supervisor, or employee of the Company or its affiliated companies; 2. The individual, their spouse, or any relative within the second degree of kinship (or using another person’s name) does not hold any shares of the Company; 3. The individual does not serve as a director, supervisor, or employee of any company with a specific relationship with the Company; 4. The individual has not received any compensation for providing business, legal, financial, or accounting services to the Company or its affiliated companies in the past two years. In accordance with the Company’s Articles of Incorporation and the “Corporate Governance Code of Practice,” directors are appointed through a candidate nomination system, with shareholders selecting candidates from a list of candidates. During the nomination and selection of Board members, the Company obtained written statements and relevant documents, including work experience, from the directors, and provided information on interested parties for verification. The Company has confirmed that the directors, their spouses, and any relatives within the second degree of kinship do not serve as directors, supervisors, or employees of the Company or its affiliated companies, demonstrating their independence from the Company. Furthermore, during the two years prior to their appointment and during their tenure, the Company has met the qualifications set forth in the “Regulations on the Establishment and Compliance of Independent Directors of Publicly Listed Companies” promulgated by the Financial Supervisory Commission and Article 14-2 of the Securities and Exchange Act. Furthermore, the independent directors have been granted the authority to fully participate in decision-making and express opinions pursuant to Article 14-3 of the Securities and Exchange Act, and have independently performed their duties accordingly, thus satisfying the requirements for independence. | 3 |

| Independent Director | He Chendan | He holds a bachelor’s degree in civil engineering from National Chung Hsing University and a master’s degree in urban planning from Virginia Polytechnic Institute and State University. He currently serves as Chairman of the Taiwan Eco-Engineering Development Foundation. He has previously served as Vice Minister of Transportation and Communications, member and Executive Director of the National Land Conservation and Development Advisory Committee of the Presidential Office of the Republic of China, Director of the Taipei City Government’s Department of Transportation, Deputy Director of the Taipei City Government’s Mass Rapid Transit Bureau, Minister of Transportation, Chairman of Chunghwa Telecom, and Chairman of Taipei Mass Rapid Transit Corporation. During his tenure at Chunghwa Telecom, he continuously promoted the privatization of the state-owned telecommunications company, which controlled fixed-line, long-distance, and mobile communications businesses, to strengthen its market competitiveness. He also introduced fiber-optic and modular optical fiber (MOD) technologies, ensuring smooth progress in Chunghwa Telecom’s privatization and organizational restructuring. | 1 | |

| Independent Director | Jian Minyi | Chairman of Yuanjing Network Communication Co., Ltd., specializing in domestic music streaming and founder of KKBOX. His experience and knowledge in the internet technology industry and startup fields can inject diverse perspectives and new momentum into online business operations. | 1 |

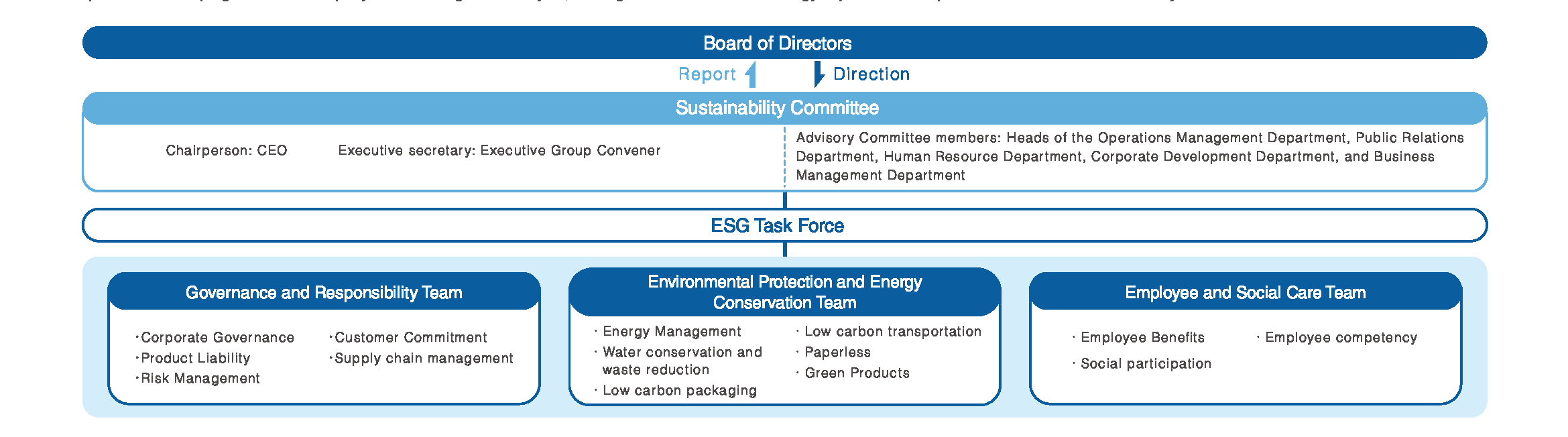

In order to effectively manage sustainability information within the organization and conduct cross-departmental communication on related business planning, PChome established the “Sustainability Committee” in 2022, with the CEO as the chairman of the committee, convening senior executives from different fields to focus on United Nations sustainability development goals, jointly review the direction of sustainable development and implementation results, and establish ESG work execution groups: governance and responsibility group, environmental protection and energy conservation group, employee and social care group, with members of each group responsible for various sustainable development strategies and action plans. Implement sustainable development goals with specific actions. The company’s board of directors regularly listens to the reports of the Sustainability Committee, keeps abreast of the progress of the company’s ESG strategy, and urges the team to make strategic adjustments and provide necessary resources when necessary.

Organization

Implementation of the Sustainability Development Committee’s meetings

The committee explained the implementation status of the company’s ESG plan (sustainable development plan) to the board of directors on 2023/01/10

work execution

- All cartons for shipping and distribution use 100% recycled pulp boxes, which has reduced carbon emissions by more than 60,000 tons by the end of 2022, which is equivalent to the carbon adsorption capacity of 155 Daan Forest Parks in one year.

- An intelligent box number recommendation system is built in the internal warehousing, and the box number accuracy rate reaches 54.7%.

- Established a special library for electronic tickets and e-books, saving 146,000 pieces of A4 paper by selling tickets annually

- The total proportion of electronic invoices used by corporate households and individual households reached 99.35%. By saving paper, a total of 2.7 Taipei 101 buildings can be stacked.

- Following the Climate-related Financial Disclosure Recommendation (TCFD), 6 climate change risks and 3 climate change opportunities related to PChome were identified.

- Support domestic sports events and successfully raise sports issues through organizing activities

- Support Taiwan’s traditional culture, sponsor Dajia Mazu circumnavigation activities, and continue Taiwan’s traditional culture.

- The chairman has held Taichung Central Bookstore’s Wednesday Reading Club for three consecutive years to promote lifelong learning, with more than 50,000 participants.

- Sponsor “Jidao Forest” to promote environmental protection and coexistence with nature

- Gender equality in the workplace, with 56% of female employees and 47% of female management positions

- There were 0 violations of labor laws and 0 complaints related to human rights.

- The average total number of employee education and training hours has increased year by year, nearly three times higher than in 2021

- Plan employee education and training courses, with an average course satisfaction score of 4.5 (out of 5)

- Overall board performance evaluation score 4.89 points (excellent)

- The first e-commerce company in Taiwan to obtain TIPS Level A certification from the “Taiwan Intellectual Property Management System”

- Accumulatively obtained 8 patents and 2 trademarks

- Establish a sustainable development committee

- Corporate governance assessment scores maintain a good performance of 6%~20%

- The number of PChome 24h shopping members exceeded 13 million

- Cooperated with the Small and Medium Enterprises Division of the Ministry of Economic Affairs to jointly promote “Buying Power Store”, and the number of products increased significantly by 59%

- Actively develop financial technology operations and provide a consumer-friendly consumption environment

- Promote various information security measures to maintain zero information security incidents

- Continue to focus on development with PiPai Wallet and actively build the One PChome ecosystem

- Expand the scale of the green product area and create a green living environment with consumers

- Actively control inventory products to allow consumers to buy with greater peace of mind

- Won the Ministry of Economic Affairs-2022 Buying Power-Second Prize

- Won the Bronze Medal Award for Digital Media Shopping from Taiwan Customer Service Center

.jpg)