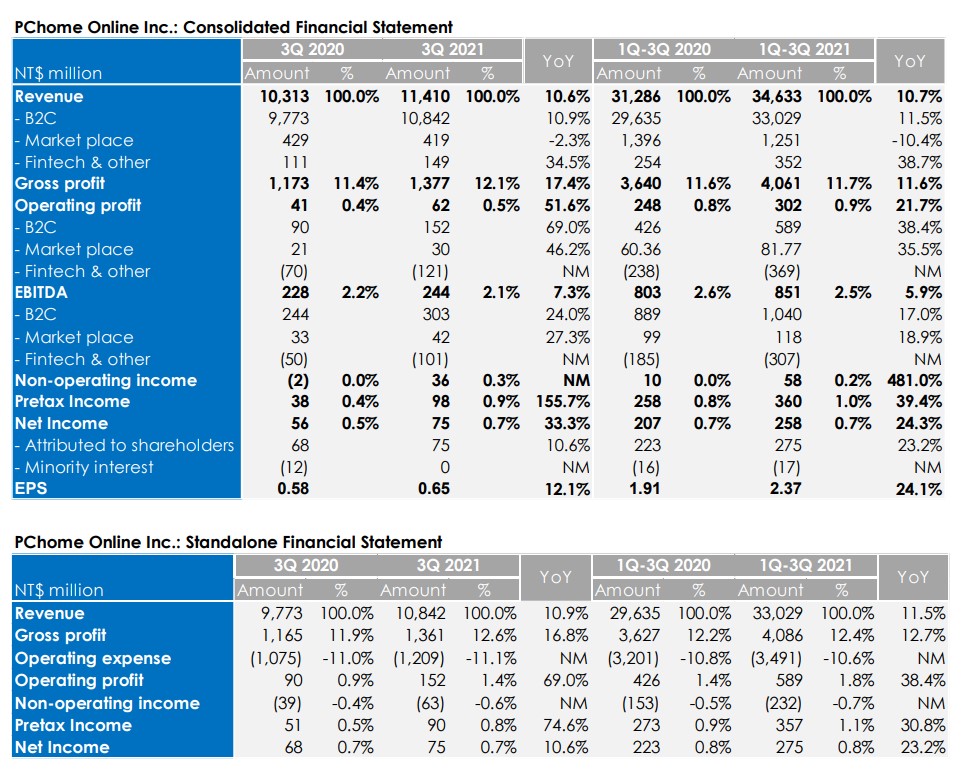

PChome Online today announced its financial results for the third quarter ended September 30, 2021. We provided the consolidated financial statement and standalone financial statement as follows. The standalone financial statement reflects a clearer picture of the B2C business.

Third Quarter 2021 Financial Highlights:

⚫ On consolidated basis:

o PChome reported a consolidated revenue of NT$11.41 billion in 3Q 2021, up 10.6% YoY but down 2.7% QoQ, as the pandemic abated and consumption behavior gradually normalized. Gross margin improved to 12.1% (vs. 11.4% in 3Q 2020), whereas the operating margin improved to 0.54% (vs. 0.40% in 3Q 2020), thanks to favorable product mix shift and continuing scale benefit.

o Operating income grew 51.6% YoY to NT$62 million in 3Q 2021, whereas pretax income grew 155.7% YoY to NT$98 million in 3Q 2021, due mainly to a revaluation gain, classified as non-operating income, from Chunghwa PChome Fund I’s portfolio companies. Due to the one-off tax benefit in 3Q 2020, net income YoY growth in 3Q 2021 was lower at 33.3%.

⚫ Within the B2C business:

o 3C categories sales grew 13.2% YoY and accounted for 73.4% of total B2C sales in 3Q 2021 vs. 72.7% in 2Q 2021 or 72.0% in 3Q 2020. Non-3C categories sales increased 5.2% YoY and accounted for 26.6% of total B2C sales in 3Q 2021 vs. 27.3% in 2Q 2021 or 28.0% in 3Q 2020. Lower Non-3C mix in this quarter was due to the slower online shopping demand for daily necessities and food products, as the pandemic eased in Taiwan.

o Gross margin achieved 12.6% in 3Q 2021, up 0.7% points YoY, which benefited from a more favorable product portfolio within both 3C and Non-3C categories.

o Operating profit was NT$152 million, an increase of 69.0% YoY in 3Q 2021, reflecting increasing scale benefit.

Other Business Highlights:

⚫ Group

o PChome introduced China Development Financial, Chunghwa Telecom and the founders of 21st Century Digital Technology Co., Ltd (“21CD”) as strategic investors who jointly subscribed PChome’s NT$1 billion private placement, representing 9,376,463 common shares of the company, or 7.35% of the enlarged share base.

⚫ Marketplace

o Marketplace revenue was down 2.3% YoY in 3Q 2021, which mainly came from the decline of PChome Store while Ruten continued to deliver stable growth.

o Marketplace operating profit increased by 46.2% to NT$30 million in 3Q 2021, reflecting the profitability improvement by Ruten’s new take rate and payment service fee scheme.

⚫ Fintech

o The acquisition of the online insurance broker E-insure was completed in 3Q 2021. PChome has also announced in Oct 2021 to acquire a controlling stake in 21CD through both old share and share exchange transaction with Pi Wallet.

o Pi Wallet has accumulated more than 1.2m registered users and over 380K merchants in 3Q 2021.

⚫ Other

o Bibian, the group’s cross-border e-commerce platform, sales in 3Q 2021 grew 161% YoY, reflected the strong demand of overseas products, and continued to show a positive bottom line.

.jpg)