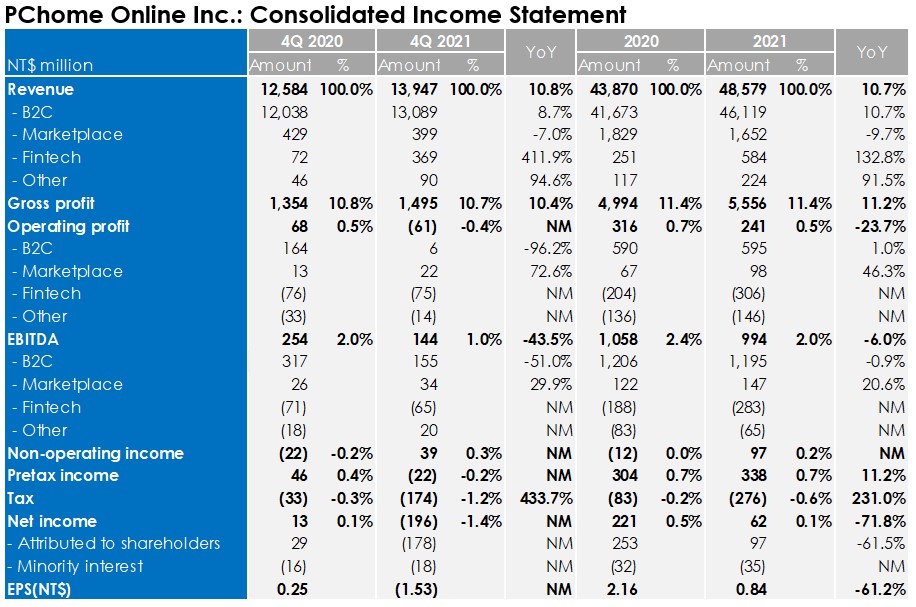

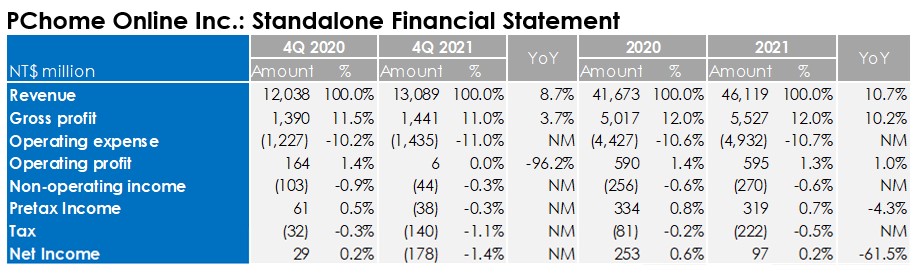

Taipei, Feb 25th, 2022 – PChome Online today announced its financial results for the fourth quarter ended December 31st, 2021. We provided the consolidated financial statement and standalone financial statement as follows. The standalone financial statement reflects a clearer picture of the B2C business.

Full Year 2021 Financial Highlights:

- The consolidated revenue was NT$48,579 million in 2021, up 10.7% YoY, driven mainly by the B2C sales (up 10.7% YoY), which showed continuous growth momentum in the e-commerce industry. Although Marketplace’s revenue was down 9.7% YoY, fintech and other businesses demonstrated strong growth with 132.8% YoY and 91.5% YoY, respectively.

- Gross margin maintained at a stable level at 11.4% compared to 2020, and gross profit increased 11.2% YoY to NT$5,556 million, mainly coming from continuing scale expansion from B2C business.

- Operating expenses increased 13.6% to NT$5,314 million, mostly resulting from higher spending in advertising and marketing campaigns particularly in 4Q 2021 to maximize the sales potential.

- Operating profit was down 23.7% YoY to NT$241 million in 2021, impacted by the severe market competitions during double 11 festival as B2C’s operating profit declined to NT$6 million in 4Q 2021. Simultaneously, the investment in new expanding businesses such as fintech and other segments reported a total operating loss of NT$452 million in 2021, compared to the operating loss of NT$340 million in 2020.

- Pretax income increased 11.4% YoY to NT$338 million, with a non-operating income of NT$97 million which was contributed by the revaluation gain from Chunghwa PChome Fund I’s portfolio companies and service fees from 21CD.

- In 2021, tax expense increased to NT$276 million, because of the capital gains tax of NT$149 million which came from the share exchange of 21CD & Pi Wallet in 4Q 2021, according to alternative minimum tax policy.

- Net income attributed to shareholders and EPS decreased by 61.5% to NT$97 million and NT$0.84, sequentially.

Fourth Quarter 2021 Financial Highlights:

- The consolidated revenue grew 10.8% YoY to NT$13,947 million in 4Q 2021, marking a historical high quarter.

- The consolidated operating loss was NT$61 million, which reflected the profit erosion in B2C which was mainly due to the increase in advertising expense, while the operating loss in fintech and other business narrowed down in 4Q 2021.

- The consolidated non-operating income of NT$39 million was mainly contributed by the revaluation gain from Chunghwa PChome Fund I’s portfolio companies and service fees from 21CD.

- The consolidated pretax loss was NT$22 million and the net loss was NT$196 million, after NT$174 million tax which included the capital gains tax of NT$149 million from 21CD transaction.

- The consolidated net loss attributed to shareholders was NT$178 million and EPS was negative NT$1.53 in 4Q 2021.

BU’s Business Highlights:

- B2C

- Within the B2C business, 3C categories sales grew 10% YoY and accounted for 74.0% of total B2C sales in 4Q 2021 vs. 73.4% in 3Q 2021 or 75.1% in 4Q 2020. Non-3C categories sales increased 4.8% YoY and accounted for 26.0% of total B2C sales in 4Q 2021 vs. 26.6% in 3Q 2021 or 24.9% in 4Q 2020. Higher 3C mix due mainly to new 3C products launch and a slowdown of demand on some N3C categories like food and life necessities as the pandemic eased in 4Q 2021.

- B2C operating margin of NT$ 6 million was due to larger spending in advertising and marketing campaigns during e-commerce shopping festivals. The advertising expense ratio was 2.7% in 4Q 2021 compared to 1.5% in 4Q 2020. And operating expense ratio increased to 11.0% in 4Q 2021 from 10.2% in 4Q 2020.

- In 4Q 2021, active users on APP up 23% YoY, and APP downloads grew by 34% YoY. Overall mobile users contributed 51% of B2C sales.

- Marketplace

- Marketplace revenue was down 9.7% YoY in 2021, which mainly came from the decline of PChome Store while Ruten continued to deliver stable growth.

- Marketplace operating profit increased by 46.3% to NT$98 million in 2021, reflecting the profitability improvement by Ruten’s new take rate and payment service fee scheme and showing the better loss control of PChome Store.

- Fintech

- Pi Wallet has accumulated more than 1.3m registered users and over 380K merchants by 4Q 2021.

- 21CD has accumulated more than 540K users with more than 2K BNPL channels by 2021.

- In 4Q 2021, fintech business, including 21CD, Pi Wallet, and e-Insure, together reported an operating loss of NT$75 million, mainly owing to the increasing investment of NT$160 million on Pi Wallet, as 21CD and E-insure total delivered NT$85 million of operating profit.

- Other

- Bibian, the group’s cross-border e-commerce platform, sales in 2021 grew 159% YoY, with a strong user growth of 184% YoY, and operating income increased over 300% YoY, benefited from the unique market proposition in overseas products.

.jpg)