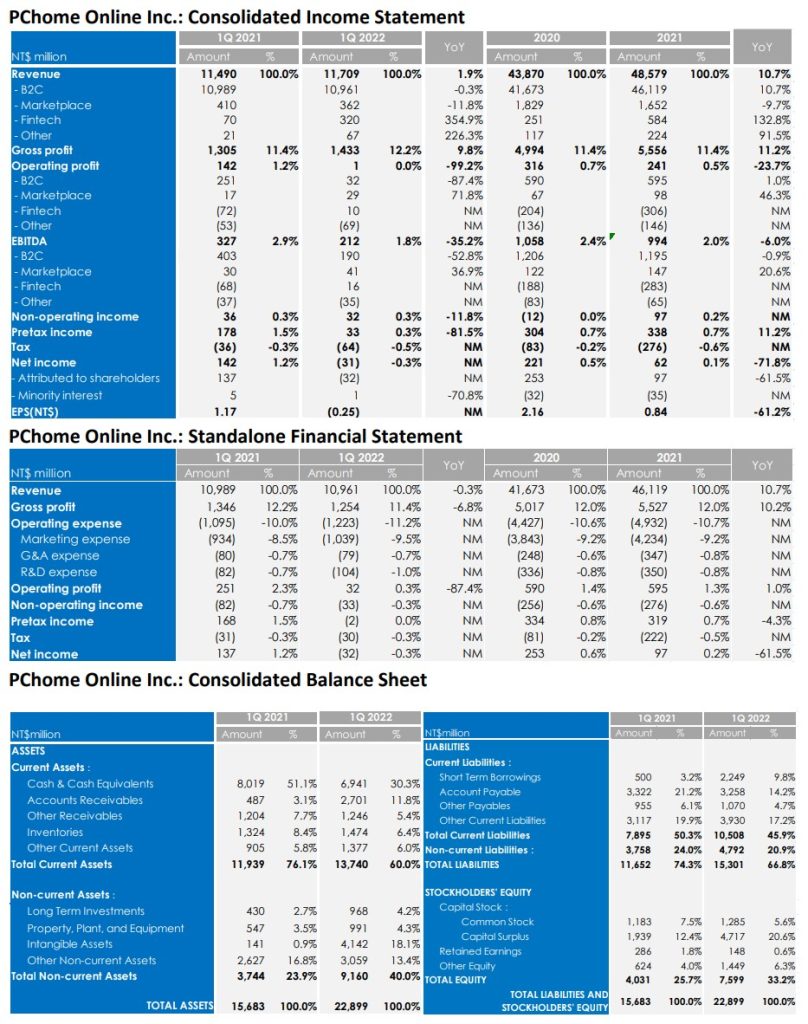

PChome Online announced financial results for the first quarter ended March 31st, 2022 today. We provided consolidated financial statements and standalone financial statements as follows. The consolidated financial statements reflect performance across all BUs, including B2C, Marketplace, Fintech, and Others. The standalone financial statements reflect a clearer picture of the B2C business.

Consolidated Financial Highlights:

- The consolidated revenue was NT$11,709 million (+1.9% YoY) in 1Q 2022, with B2C sales of NT$10,961 million (-0.3% YoY), Marketplace sales of NT$362 million (-11.8% YoY), Fintech sales of NT$320 million (+354.9% YoY) and Other sales of NT$67 million (+226.3% YoY).

- The consolidated gross margin was 12.2% in 1Q 2022 (vs. 11.4% in 1Q 2021), with an increase of NT$128 million primarily contributed by the improvement of the Fintech BU.

- The consolidated operating expenses ratio was 12.2% in 1Q 2022 (vs. 10.1% in 1Q 2021), with an increase of NT$269 million in total.

o Selling and Marketing expenses ratio was 8.9% (vs. 7.9% in 1Q 2021), with an increase of NT$141 million, due to increased spending on B2C marketing and promotion activities.

o General and Administrative expense ratio was 1.5% (vs. 1.1% in 1Q 2021), with an increase of NT$55 million), mostly due to intangible asset amortization and the G&A expense from newly consolidated Fintech entities.

o Research and Development expensesratio was 1.3% (vs. 1.1% in 1Q 2021), with an increasing amount of NT$22 million, due to new IT investments for the B2C BU across cloud, AI, and UI/UX.

o Additional expected credit loss expenses ratio of 0.4%, representing NT$52 million in dollar amount, was recognized due to the consolidation of fintech business.

- The consolidated operating profit was NT$1 million (-99.2% YoY) in 1Q 2022, with a decrease of NT$141 million.

o B2C’s operating profit declined to NT$32 million (-87.4% YoY) in 1Q 2022, affected by severe market competition in the E-commerce sector, supply chain issues, and increased marketing and promotion activities.

o Marketplace’s operating profit increased to NT$29 million (+71.8% YoY) in 1Q 2022, reflecting profitability improvement trends driven by Ruten’s new payment service scheme.

o Fintech business delivered a historical high record of NT$10 million operating profit compared to an operating loss of NT$72 million in 1Q 2021, driven by synergies of the acquired Fintech arm and strengthened monetization capabilities of the Fintech BU.

o Other business, including cross-border business, consolidation adjustments, and eliminations, reported an operating loss of NT$69 million in 1Q 2022.

- The non-operating income of NT$32 million in 1Q 2022 reflected the recovery gain of Fintech BU and is expected to have a recurring nature looking forward.

- The tax expense of NT$64 million reflected Fintech BU tax increase as profitability 2 improved, and consisted one-time capital gain tax of NT$29 million due to the share exchange of 21CD & Pi Wallet in 1Q 2022

- Net loss attributed to shareholders and EPS was NT$32 million and negative NT$0.25, respectively.

BU’s Business Highlights:

- B2C

o Within the B2C business, 3C categories sales declined 1.5% YoY and accounted for 72.1% of total B2C sales in 1Q 2022 (vs. 74.0% in 4Q 2021 or 73.0% in 1Q 2021). Non-3C categories sales increased 3.1% YoY and accounted for 27.9% of total B2C sales in 1Q 2022 (vs. 26.0% in 4Q 2021 or 27.0% in 1Q 2021). Non-3C categories sales continued to expand on top of the high base period from COVID-19 impacts in 2021. However, supply chain impacts and shortage of top-selling brand electronic products have resulted in declining 3C category sales.

o B2C gross margin was 11.4% (vs. 11.0% in 4Q 2021 or 12.2% in 1Q 2021), affected by the intensified market competition and supply constraints for 3C categories, especially on high-margin 3C category products. However, low-margin orders were also affected due to subsidy policy adjustments in the joint campaigns with bank partners, resulting in a QoQ improvement.

o B2C operating expense ratio was 11.2%, with an increasing amount of NT$127 million, in which NT$105 million came from increased marketing expense and NT$22 million from additional R&D investment.

o B2C’s operating profit was down 87.4% YoY but up 404.1% QoQ to NT$32 million in 1Q 2022, enhanced profitability showing improving product mix and margin structure.

o In 1Q 2022, APP active users were up 12% YoY, and APP downloads grew by 31% YoY. Overall mobile users contributed 53% of B2C sales.

- Marketplace

o Marketplace revenue was down 11.8% YoY in 1Q 2022, which primarily came from the decline of PChome Store.

o Marketplace’s operating profit was up 71.8% YoY to NT$29 million in 1Q 2022, reflecting profitability improvement trends driven by Ruten’s new payment service scheme.

- Fintech

o The Fintech BU (including Pi Wallet, 21CD, Cherri Tech, and e-Insure) has accumulated over 2 million users and developed a strong network of online and offline merchants as of 1Q 2022.

o 21st Financial Technology announced to acquire Cherri Technology through exchanging 4.16 million newly issued shares (~7.5% dilution for 21st Financial Technology) and investing NT$940 million in cash. Closing is targeted in July 2022.

o Cherri Technology is a leading payment gateway solutions provider with over NT$50 billion GPV in 2021, empowering merchants with seamless payment solutions and strengthening payment security via AI anti-fraud solutions.

o In April 2022, Fintech BU launched PayLater, the first BNPL service accessed through mobile wallets in Taiwan. The combined synergy of Pi and 21CD will 3 allow users to access flexible financing solutions anywhere and anytime, leveraging 21CD technology capabilities to better serve our users.

- Other

o Cross-border business performed a strong sales growth momentum in 1Q 2022 with 57.4% YoY, mainly contributed from Bibian, the group’s cross-border e-commerce platform based in Japan.

.jpg)