Taipei, Nov 4th, 2022 – PChome Online announced financial results for the third quarter ended Sep 30th, 2022 today. We provided consolidated financial statements and standalone financial statements as follows. The consolidated financial statements reflect performance across all BUs, including B2C, Marketplace, Fintech, and Others. The standalone financial statements reflect a clearer picture of the B2C business.

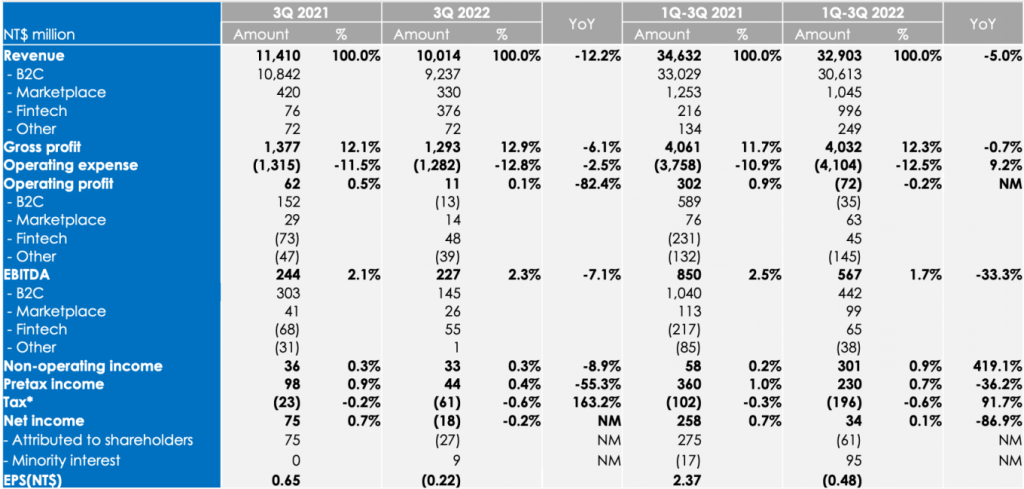

Third Quarter 2022 Consolidated Financial Highlights:

• The consolidated revenue was NT$10,014 million (-12.2% YoY) in 3Q 2022, with B2C sales of NT$9,237 million (-14.8% YoY), Marketplace sales of NT$330 million (-21.5% YoY), Fintech sales of NT$376 million (+394.8% YoY) and Other sales of NT$72 million (-0.6% YoY).

o B2C: 3C categories sales declined 16.1% YoY and accounted for 72.3% of total B2C sales in 3Q 2022 (vs. 72.1% in 2Q 2022 or 73.4% in 3Q 2021). Non-3C categories sales declined 11.2% YoY and accounted for 27.7% of total B2C sales in 3Q 2022 (vs. 27.9% in 2Q 2022 or 26.6% in 3Q 2021).

o All categories are affected by macro headwinds including pressures on consumer spending and normalized e-commerce demand. At the same time, consumer behavior is adjusting to the post-pandemic era as offline shopping behavior revives.

• The consolidated gross margin grew to 12.9% in 3Q 2022 (vs. 12.1% in 3Q 2021) because of Fintech BU contribution, despite B2C business facing intensified market competition since no price discount on 3C products in 21Q3 given the Covid WFH trend.

• The consolidated operating expenses ratio was 12.8% in 3Q 2022 (vs. 11.5% in 3Q 2021), mainly due to the newly consolidated Fintech arm while B2C expense decreased 13.8% YoY.

o Selling and Marketing expenses ratio was 8.9% (vs. 9.0% in 3Q 2021), with a decreasing amount of NT$132 million, reflecting the advertising expense optimization of B2C BU.

o General and Administrative expense ratio was 2.0% (vs. 1.3% in 3Q 2021), with an increasing amount of NT$49 million, mostly coming from the newly consolidated Fintech arm, the amortization of intangible assets from past acquisitions.

o Research and Development expenses ratio was 1.6% (vs. 1.2% in 3Q 2021), with an increasing amount of NT$17 million, as B2C BU continued to invest in cloud migration and UIUX optimization.

• The consolidated operating profit was NT$11 million in 3Q 2022, with an increasing amount of NT$95 million compared to 2Q 2022.

o B2C BU’s operating loss narrowed down to NT$13 million in 3Q 2022 sequentially, reflecting the positive impact of cost control and a better marketing expense allocation.

o Marketplace BU’s operating profit was NT$14 million in 3Q 2022, impacted by the slowdown in online shopping in the C2C market.

o Fintech BU’s delivered an operating profit of NT$48 million and a recovery gain of NT$43 million, totaling a NT$91 million pretax profit in 3Q 2022, including a 2 one-off gain of NT$48mn due to account adjustment on expected credit loss.

o Other business, including cross-border business, consolidation adjustments, and eliminations, reported an operating loss of NT$39 million in 3Q 2022.

• The Consolidated Non-operating income was NT$33 million in 3Q 2022, consisting of the NT$10 million investment revaluation loss of Chunghwa PChome Fund I and the recovery gain of NT$43 million of Fintech BU.

• The tax expense was NT$61 million, including NT$16 million amortization of capital gain tax due to the share exchange of 21CD & Pi Wallet this year and NT$45 million income tax from Marketplace and Fintech BU.

• The consolidated net loss was NT$18 million, net income attributed to minority interest was NT$9 million, net loss attributed to shareholders and EPS was NT$27 million and negative NT$0.22, respectively.

PChome Online Inc.: Consolidated Income Statement

PChome Online Inc.: Standalone Financial Statement

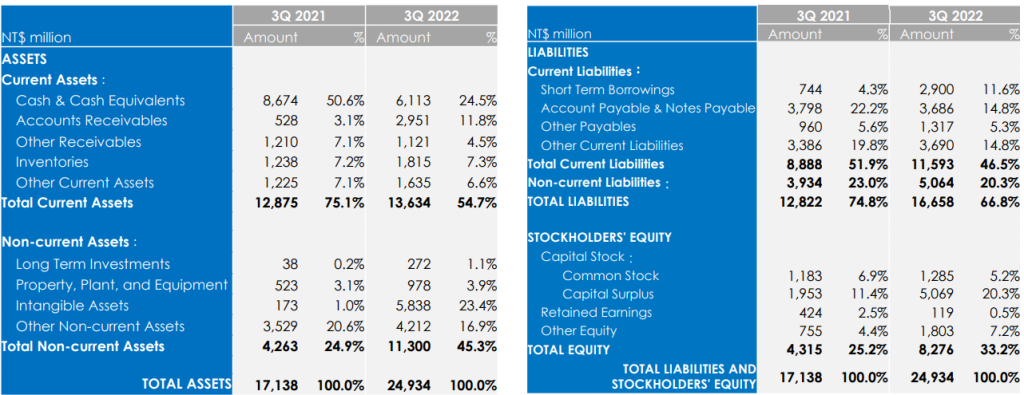

PChome Online Inc.: Consolidated Balance Sheet

.jpg)