Taipei, August 14th, 2023 – PChome Online announced financial results for the second quarter ended June 30th, 2023 today. We provided consolidated financial statements and standalone financial statements as follows. The consolidated financial statements reflect performance across all BUs, including B2C, Marketplace, Fintech, and Others BU. The standalone financial statements reflect a clearer picture of the B2C business.

Update on 2023 Rights Offering:

- Effective on August 11th, PChome announced the completion of a NT$641.6 million capital increase, issuing 16,000,000 new common shares at NT$40.1 per share. Following the 2023 rights offering, the company’s total issued shares would be 144,162,945 shares.

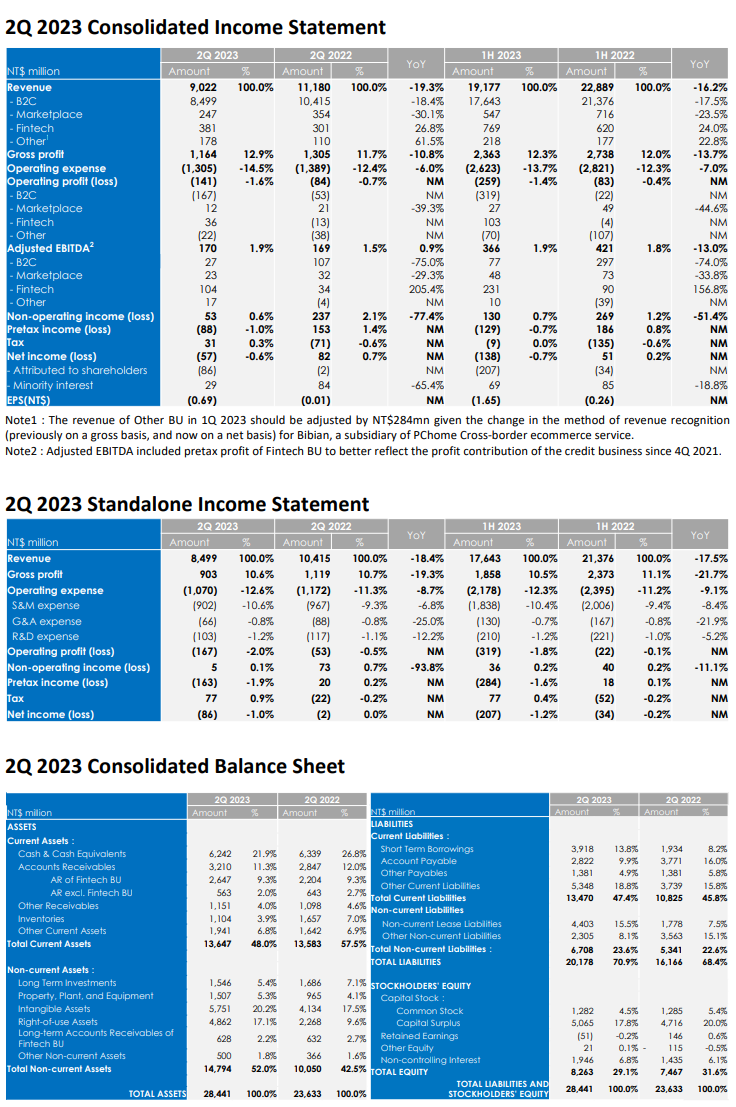

Second Quarter 2023 Consolidated Financial Highlights:

- The consolidated revenue was NT$9,022million (-19.3% YoY) in 2Q 2023, with B2C sales of NT$8,499 million (-18.4% YoY), Marketplace sales of NT$247 million (-30.1% YoY), Fintech sales of NT$381 million (+26.8% YoY) and Other sales (including group adjustments) of NT$178 million (+61.5% YoY).

- B2C: 3C categories sales declined 18.4% YoY and accounted for 70.7% of total B2C sales in 2Q 2023 (vs. 71.0% in 1Q 2023 or 70.7% in 2Q 2022). Non-3C categories sales declined 18.3% YoY and accounted for 29.3% of total B2C sales in 2Q 2023 (vs. 29.0% in 1Q 2023 or 29.3% in 2Q 2022). The restrained revenue momentum was attributed to overall weaker demand for 3C-related products, along with a spending shift in consumer budgets towards physical retail, including outdoor travel categories.

- Marketplace BU sales decreased by 30.1% YoY in 2Q 2023, also impacted by the softening e-commerce demand for consumer electronics and household products.

- Fintech BU sales continued to deliver a healthy growth of 26.8% YoY in 2Q 2023, primarily driven by the growth of merchant services and credit offerings.

- Other BU sales, including group consolidation adjustments, and eliminations, increased by 61.5% YoY in 2Q 2023, with a one-time adjustment of NT$284 million due to the change in the method of revenue recognition (previously on a gross basis, and now on a net basis) for Bibian, a subsidiary of PChome cross- border e-commerce service.

- The consolidated gross profit was NT$1,164 million (-10.8% YoY) in 2Q 2023, down by NT$141 million, mainly due to the gross profit decline from the B2C BU.

- The consolidated operating expenses was NT$1,305 million (-6.0% YoY) in 2Q 2023, down by NT$84 million compared to 2Q 2022, mainly originating from the cost control measures implemented in the B2C BU.

- Selling and Marketing expenses decreased NT$61 million compared to the amount in 2Q 2022, with a ratio of 9.9% in 2Q 2023 (vs. 8.6% in 2Q 2022).

- General and Administrative expenses decreased NT$14 million compared to the amount in 2Q 2022, with a ratio of 1.9% in 2Q 2023 (vs. 1.7% in 2Q 2022).

- Research and Development expenses decreased NT$35 million compared to the amount in 2Q 2022, with a ratio of 1.5% in 2Q 2023 (vs. 1.5% in 2Q 2022).

- Provision expense was NT$96 million, up by NT$27 million compared to the amount in 2Q 2022, reflecting the growing credit portfolio of Fintech BU.

- The consolidated operating loss was NT$141 million in 2Q 2023, a decreasing amount of NT$58 million compared to 2Q 2022.

- B2C BU’s operating loss was NT$167 million in 2Q 2023, a decreasing amount of NT$114 million compared to 2Q 2022, while operational efficiency has improved, the constraints posed by revenue scale and fixed logistics costs have remained.

- Marketplace BU’s operating profit was NT$12 million, a decreasing amount of NT$8 million compared to 2Q 2022.

- Fintech BU’s operating profit was NT$36 million and recorded a recovery gain of NT$61 million, totaling a NT$97 million pretax profit in 2Q 2023, with an increasing amount of NT$69 million compared to 2Q 2022.

- Other BU, including cross-border business, consolidation adjustments, and eliminations, reported an operating loss of NT$22 million in 2Q 2023.

- The consolidated non-operating income was NT$53 million in 2Q 2023, consisting of the recovery gain of NT$61 million from Fintech BU.

- The tax income was NT$31 million, mainly attributed to the tax refund of NT$77 million from the recognition of capital loss due to capital reduction of PChomePay (merged by Pi Wallet) in 2020.

- The consolidated net loss was NT$57 million, net income attributed to minority interest was NT$29 million, net loss attributed to shareholders and EPS was NT$86 million and NT$(0.69), respectively.

For more financial details, please visit Market Observation Post System.

.jpg)