Taipei, November 13th, 2023 – PChome Online announced financial results for the third quarter ended September 30th, 2023 today. We provided consolidated financial statements and standalone financial statements as follows. The consolidated financial statements reflect performance across all BUs, including B2C, Marketplace, Fintech, and Others BU. The standalone financial statements reflect a clearer picture of the B2C business.

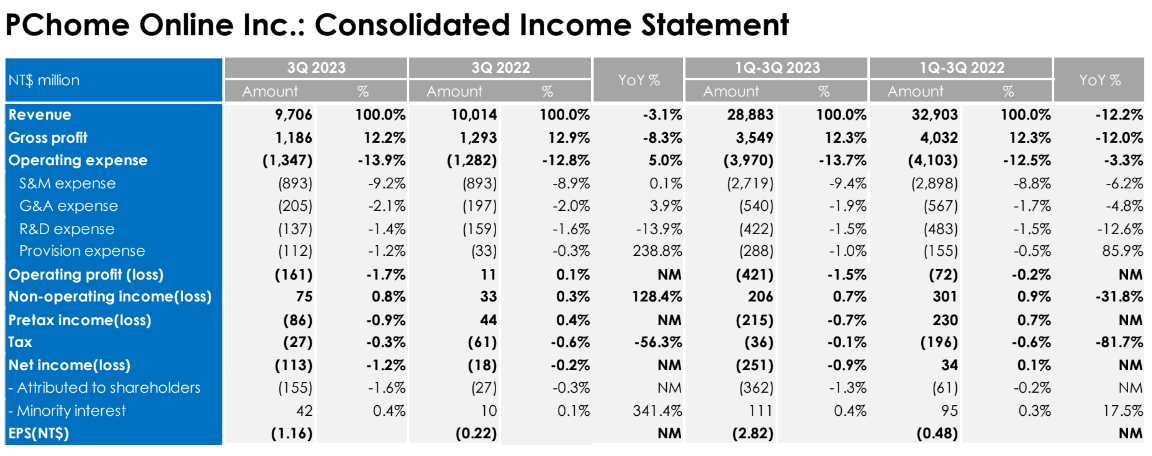

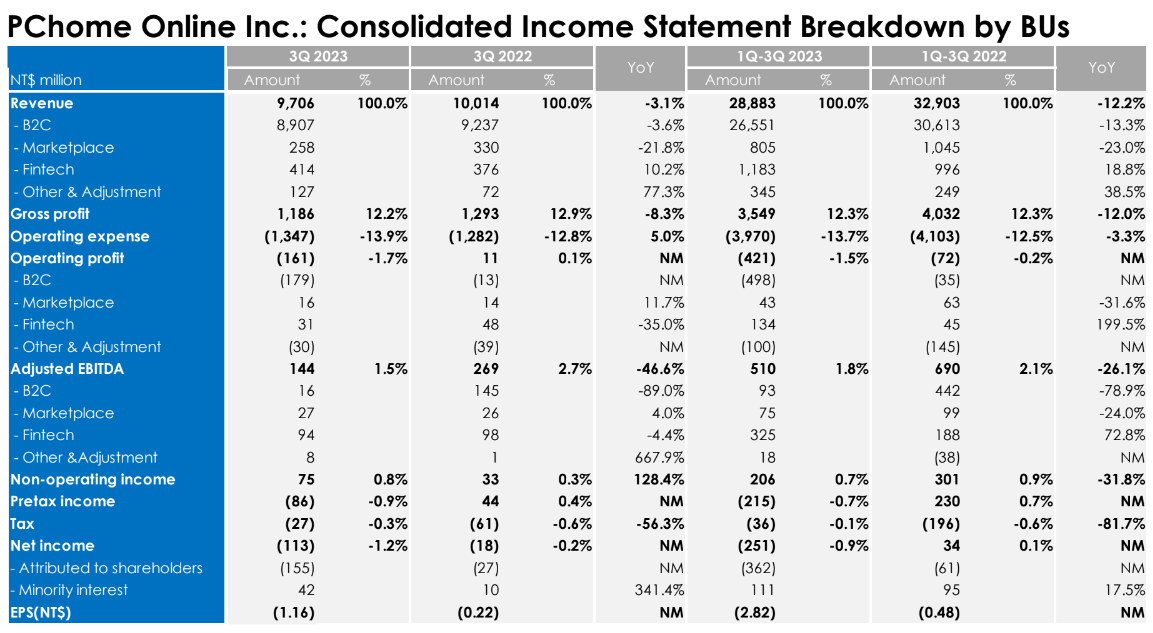

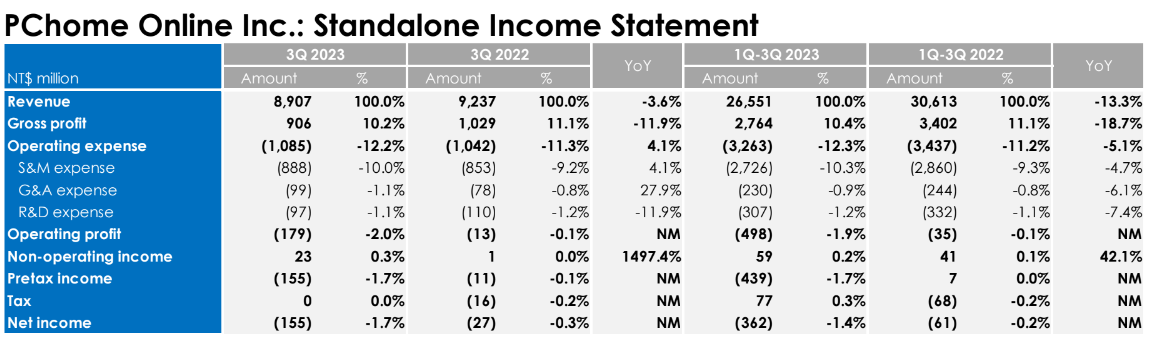

Third Quarter 2023 Consolidated Financial Highlights:

- The consolidated revenue was NT$9,706 million (-3.1% YoY) in 3Q 2023, with B2C sales of NT$8,907 million (-3.6% YoY), Marketplace sales of NT$258 million (-21.8% YoY), Fintech sales of NT$414 million (+10.2% YoY) and Other sales (including group adjustments) of NT$127 million (+77.3% YoY).

o B2C: 3C categories sales declined 4.1% YoY and accounted for 70.5% of total B2C sales in 3Q 2023 (vs. 70.7% in 2Q 2023 or 70.8% in 3Q 2022). Non-3C

categories sales declined 2.3% YoY and accounted for 29.5% of total B2C sales in 3Q 2023 (vs. 29.3% in 2Q 2023 or 29.2% in 3Q 2022). The YoY decline

percentage in revenue significantly narrowed compared to 1H 2023, reflecting the recovery sign of e-commerce demand, especially in branded 3C products.

o Marketplace BU sales decreased by 21.8% YoY in 3Q 2023, attributed to the ongoing restructuring project at PCStore, which has enhanced operational efficiency and boosted operating profits of this BU to grow.

o Fintech BU sales increased 10.2% YoY in 3Q 2023, primarily driven by the growth of credit portfolios and merchant services.

o Other BU sales, including consolidation adjustments and eliminations, increased by 77.3% YoY in 3Q 2023.

- The consolidated gross profit was NT$1,186 million (-8.3% YoY) in 3Q 2023, down by NT$108 million, mainly due to the gross profit decline from the B2C BU.

- The consolidated operating expenses was NT$1,347 million (+5.0% YoY) in 3Q 2023, up by NT$65 million compared to 3Q 2022, primarily came from the increasing provision expense of NT$79 million in Fintech BU, also the increasing depreciation expenses offsetting the effect of cost control measures implemented in the B2C BU.

o Selling and Marketing expenses maintained flattish compared to the amount in 3Q 2022, with a ratio of 9.2% in 3Q 2023 (vs. 8.9% in 3Q 2022), despite the increment of A7 expense from B2C BU.

o General and Administrative expenses increased NT$8 million compared to the amount in 3Q 2022, with a ratio of 2.1% in 3Q 2023 (vs. 2.0% in 3Q 2022).

o Research and Development expenses decreased NT$22 million compared to the amount in 3Q 2022, with a ratio of 1.4% in 3Q 2023 (vs. 1.6% in 3Q 2022).

o The gross provision expense amounted to NT$112 million, marking an increase of NT$79 million from the 3Q 2022 figure, whereas the net provision expense, adjusting for the recovery gain of NT$56 million recorded at non-operating profit vs. NT$30 million in 3Q 2022, was NT$55 million in 3Q 2023 vs. NT$2 million in 3Q 2022, which was deflated by a one-off accounting adjustment of NT$48 million in 3Q 2022.

The consolidated operating loss was NT$161 million in 3Q 2023, a decreasing amount of NT$172 million compared to 3Q 2022.

o B2C BU reported an operating loss of NT$179 million in 3Q 2023, primarily attributed to challenges in market competition, leading to an overall decline in

gross profit.

o Marketplace BU’s operating profit was NT$16 million, an increasing amount of NT$2 million compared to 3Q 2022, reflecting the synergies in cost efficiency

of the consolidation.

o Fintech BU’s operating profit was NT$31 million and recorded a recovery gain of NT$56 million, totaling a NT$88 million pretax profit in 3Q 2023, with a

decreasing amount of NT$3 million compared to 3Q 2022.

o Other BU, including cross-border business, consolidation adjustments, and eliminations, reported an operating loss of NT$30 million in 3Q 2023.

- The consolidated non-operating income was NT$75 million in 3Q 2023, consisting of the recovery gain of NT$56 million from Fintech BU.

- The tax expense was NT$27 million, mainly came from the tax expense from the profitable Fintech and Other BU.

- The consolidated net loss was NT$113 million, net income attributed to minority interest was NT$42 million, net loss attributed to shareholders and EPS was NT$155 million and NT$(1.16), respectively.

PChome Online Inc.: Consolidated Income Statement

日超級加碼日回饋再升級,祭出全站最高回饋高達45%的超殺優惠-1.jpg)

.jpg)